All About Personal Loans Canada

All About Personal Loans Canada

Blog Article

The Best Guide To Personal Loans Canada

Table of ContentsThe Best Guide To Personal Loans CanadaGetting My Personal Loans Canada To WorkThe Ultimate Guide To Personal Loans CanadaAn Unbiased View of Personal Loans CanadaPersonal Loans Canada Things To Know Before You Buy

This means you have actually provided every solitary dollar a task to do. placing you back in the vehicle driver's seat of your financeswhere you belong. Doing a regular budget plan will give you the confidence you require to handle your money efficiently. Good things concern those who wait.Saving up for the huge things means you're not going into financial debt for them. And you aren't paying more in the future as a result of all that rate of interest. Trust fund us, you'll take pleasure in that family cruise or playground collection for the kids way more understanding it's currently paid for (rather than paying on them up until they're off to college).

Nothing beats tranquility of mind (without debt of course)! You do not have to turn to personal finances and financial obligation when points get tight. You can be totally free of financial obligation and start making actual traction with your cash.

An individual car loan is not a line of debt, as in, it is not revolving financing. When you're authorized for an individual finance, your lender gives you the full amount all at when and after that, generally, within a month, you begin settlement.

All about Personal Loans Canada

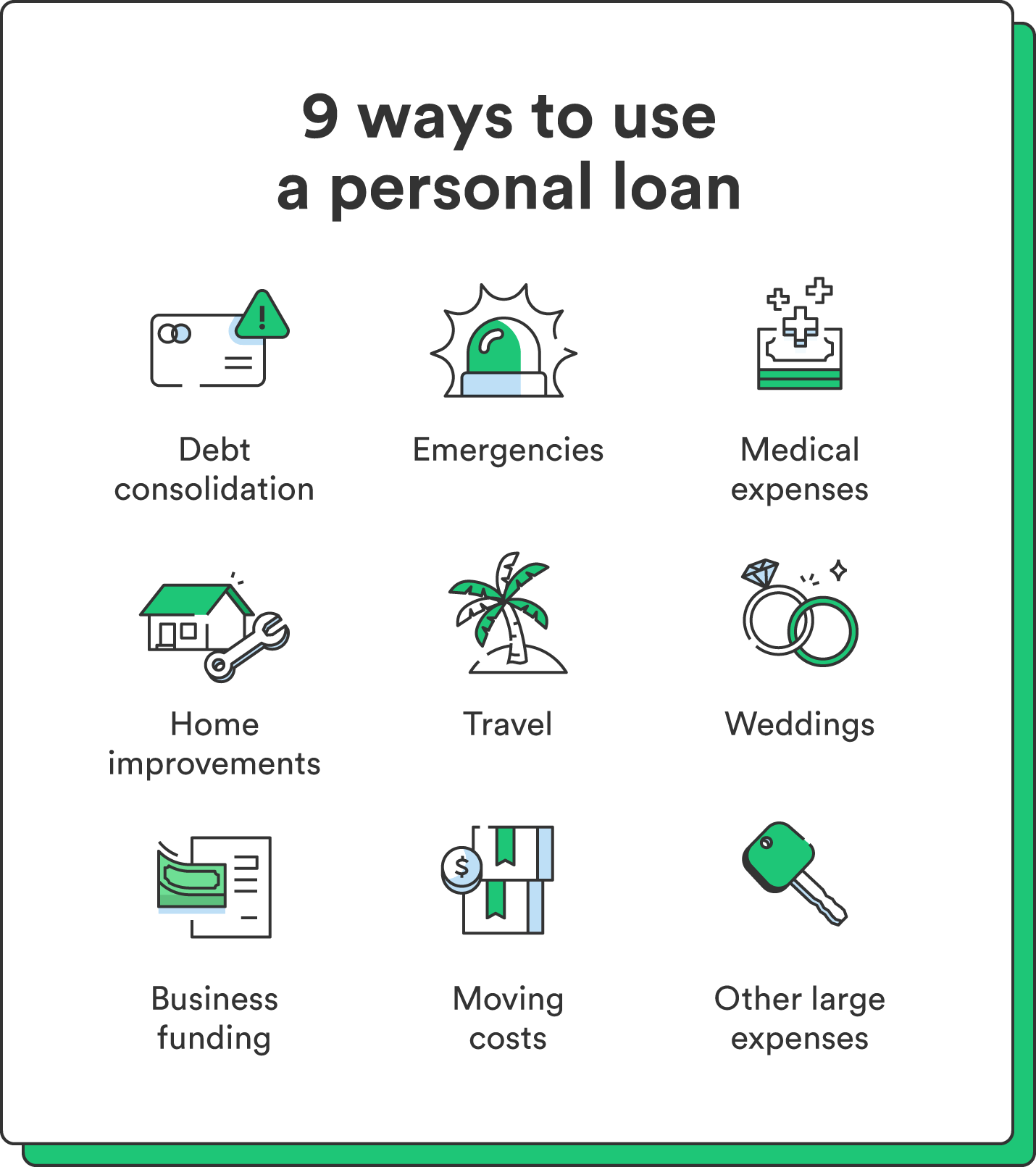

Some banks placed stipulations on what you can use the funds for, however many do not (they'll still ask on the application).

The need for personal fundings is climbing among Canadians interested in leaving the cycle of payday finances, settling their financial obligation, and restoring their credit rating rating. If you're using for an individual car loan, below are some points you need to maintain in mind.

How Personal Loans Canada can Save You Time, Stress, and Money.

Furthermore, you could be able to decrease how much complete passion you pay, which suggests even more cash can be saved. Individual car loans are powerful devices for developing your credit history. Payment history make up 35% of your credit history, so the longer you make regular settlements on time the a lot more you will certainly see your score boost.

Individual car loans provide a terrific opportunity for you to rebuild your credit score and pay off financial obligation, however if you don't budget plan properly, you can dig on your own into an also much deeper hole. Missing among your month-to-month payments can have an unfavorable result on your credit history however missing out on several can be ruining.

Be prepared to make every settlement promptly. It holds true that a personal financing can be utilized for anything and it's less complicated to obtain approved than it ever before was in the past. Yet if you don't have an immediate requirement the extra cash money, it may not be the ideal remedy for you.

The dealt with monthly repayment quantity on an individual funding relies on how much you're borrowing, the interest rate, and the set term. Personal Loans Canada. Your rates of interest will depend upon factors like your credit history and revenue. Often times, personal lending prices visit site are a whole lot less than charge card, yet occasionally they can be higher

The Best Guide To Personal Loans Canada

Benefits consist of terrific interest prices, exceptionally fast handling and funding times & the privacy you may want. Not every person likes strolling right into a financial institution to ask for money, so if this is a difficult place for you, or you simply don't have time, looking at on the internet lenders like Springtime is a great choice.

Settlement lengths for individual loans normally drop within 9, 12, 24, 36, 48, or 60 months (Personal Loans Canada). Much shorter payment times have very high monthly payments our website however after that it's over quickly and you do not lose more cash to interest.

Personal Loans Canada Fundamentals Explained

Your rates of interest can be tied to your repayment duration as well. You might obtain a reduced interest rate if you fund the finance over a much shorter duration. A personal term car loan comes with an agreed upon payment timetable and a repaired or drifting rate of interest. With a drifting rates of interest, the interest quantity you pay will certainly rise and fall click reference month to month based upon market changes.

Report this page